Investing for your child’s financial future can be daunting – with so many options, most parents aren’t sure where to start. This is a starting point to guide you through the (seemingly scary) subject of finance and savings.

I didn’t learn about investment and savings as a child. There is a vivid memory of a friend telling me that I needed to open an ISA and start investing. An idea I dismissed without thinking about it!

When did I start focusing on children’s financial futures?

When I started working in the financial advice industry I started understanding the differences between the various options out there. Importantly, I also learnt which ones were suitable for which goal.

I also started noticing all the mistakes I had made in my 20’s. I don’t like to think of the thousands of pounds they cost me! At this point I promised myself to do everything I could to provide my kids with the right financial education. My hope is that it will help them avoid making the same silly mistakes I did. Like not maxing out my pension, sticking to a savings account rather than investing, not having an emergency fund …. the list goes on. I decided I would do this by investing in their financial future from the day they were born. My wife and I talk to them about the investments openly as they (and their savings) grow. I also decided to build Hapi to help me, and other parents, save & invest for their children’s futures.

Why start investing for your children’s future?

1. Everything is getting more and more expensive

Let’s get the obvious out of the way first. Costs are increasing. University (which may have been free for you ) now costs £9,250 a year, and that’s before you even think about living costs for the three years of education. House prices have been increasing by an average of 5.4% a year (across the UK) for the last 20 years. The average price paid by a first-time buyer in 2020 was £256,057 so just imagine what that could be by the time your children start thinking about entering the property market.

I have aspirations that my kids won’t be renting for as long as I have been (my wife and I are still renting now) but I’m realistic and know that’s going to be impossible unless they have a helping hand.

2. Teach them about money

I want my kids to grow up financially literate. For me this starts by talking openly about money at home. Having a separate money pot for your kids allows you to do just this. You can start teaching them about the importance of putting money aside regularly and how it all adds up. If you’ve invested that money you can start talking about compounding and the benefits of long term investments. There are many ways you can teach your kids about finance. As these crucial lessons aren’t taught in school, it’s our job as parents to teach them.

3. You can’t rely on the state anymore

In October 2020 the state pension age changed. This means anyone born after 5 October 1954 has to be at least 66 years old to receive state pension. By 2028, that’s likely to be 67. The national debt has grown tremendously in the last 12 months. I dread to imagine how high the state pension age will be when our kids retire.

How to approach investing for your child’s financial future?

As a parent I assume you’ve heard of a junior savings account. Maybe you even went to your local bank and opened one for your child. Although saving money in a bank is a great start, it is rarely the best long term investment. This is due to low interest rates. So what other types of accounts can you open for your child?

Junior ISA

Another popular way to start investing for your child’s financial future is through a Junior ISA (JISA). Just like an adult ISA, this is a tax-free account. You can either open a cash JISA (one that deposits your money in a bank or building society and pays a fixed interest rate). Or a stocks & shares JISA (an investment account which uses your money to buy stocks, shares & other investments). Because a stocks & shares JISA is an investment, the return isn’t guaranteed. Whilst they tend to perform better than cash JISAs over the longer term, the value of the investments can sometimes go down as well as up.

Unlike an adult ISA however, the money is locked up until the child turns 18 (meaning it can’t be withdrawn or accessed before that age) and at the age of 18 it automatically is converted into an adult ISA in the child’s name (meaning they have full control over it and can spend as they like). More information about JISAs and how they work can be found here.

Where did JISAs start?

The government introduced these in 2011 as a way to encourage parents to put money aside for their children’s future, and between then and 2019 (latest date that public data is available) over 4.6m Junior ISAs were opened. Out of those 4.6m, 3.25m were cash JISAs (70%) and 1.38m were stocks and shares JISAs (30%). Whilst this suggests that cash JISAs are more popular, I think it’s interesting to take a look at the average amount going into each of the two types.

In the 2018/19 tax year, the average amount deposited into a Junior cash ISA was £830 while the average amount invested via a stocks & shares JISA was £1,465. This highlights that while cash JISAs are more popular, on average more money goes into stocks & shares JISA.

For me this makes sense, and although I’m generalising this could be because those with more money to spare (and therefore more money to invest for their child’s financial future) are more likely to have financial advisers who suggest to them that stocks & shares JISAs are the better option for their long term savings.

But why do financial advisers usually recommend stocks & shares JISAs instead of cash JISAs?

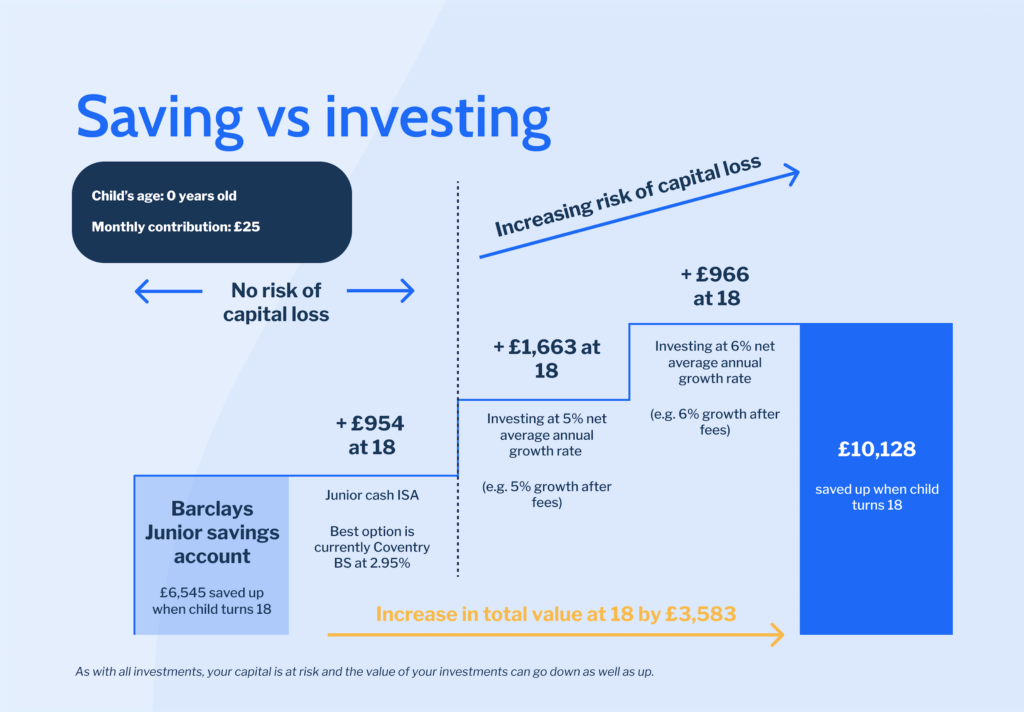

Today, the best easy access junior savings account pays 1.50% (up to £10,000) and the best cash JISA pays 2.95%. This might seem very high when you compare it to your own savings accounts and cash ISAs but over a long time period (18 years if you start putting money aside as soon as your child is born), the savings account is likely to be eroded by inflation and the cash JISA would only just beat inflation.

So while investing does come with more risk (the value of your investments can go down as well as up), it is likely to be the best way to beat inflation and grow your money over the long term.

The example below compares the performance of savings accounts vs. investments if you start putting £100 a month aside for your child from the day they’re born till the day they turn 18. As you can see even though investing comes with extra risk, it can make a huge difference to the amount of money in the pot at 18. If you’re still unsure about saving vs investing then this may help you figure out which one is right for you and your goals.

How else can I invest in my child’s financial future?

- Bare trust – Like a JISA, at the age of 18 the money belongs to the child and they can do with it as they see fit. Unlike a JISA, you can access it before the child turns 18 providing you use the money for the kids benefit (e.g. school fees). However, for that additional flexibility, you give up some tax efficiency and a bare trust is usually less tax efficient than a JISA.

- Junior pension – Everything you put in gets a 20% tax relief from the government (up to the maximum annual limit), however your child can’t access the money till the minimum pension age (currently 55 but who knows how high it’ll be by the time your child is older). These might not be right for you for a few reasons mentioned here so think carefully before opening one.

- Invest through your own name – For ultimate flexibility you can look to invest through your own name. This is likely to be less tax efficient than investing through your child’s name. It gives you full control over when the money is used and how it’s used.

Summary:

So what did we do? My wife and I agreed that we do want to start investing for our child’s financial future, and we do want to have some money aside for our daughter that’s in her name. She can use this to start a business, pay for uni fees, travel the world or whatever she decides. We decided to invest this money. We’re firm believers that in the long term investing beats money sitting in a bank account.

By being open with my daughter about money – and how hard we’ve had to work to be able to set aside a little amount every month for her future, I hope she’ll be smarter with how she manages that money.

If you want to speak to me about teaching kids about money, investing for your child’s financial future, or anything else that this post got you thinking about then feel free to head over to Hapi. I’m a Dadvenger at heart and so would love to help you and your family reach your goals!

Disclaimer:

The views expressed here are intended to provide guidance and general information and should not be taken as financial advice. When investing your capital is at risk and the value of your investments may go down as well as up. Tax treatment depends on your unique circumstances and if in doubt you should speak to a financial adviser or tax specialist.

Has this post helped you?

Have you got requests or suggestions for more posts focused on investing in your child’s financial future? Maybe you would like to write a post on the subject yourself. Please leave your comments in the section below and share this post and other Dadvengers Posts with your family and parenting friends.

Dadvengers is a community of parents (that’s Mums and Dad’s) focused on supporting Dads on their journey through parenthood.